Reproduced from a 9 March 2011 article by courtesy of "Transport Trackers"

We are still in the growth deceleration conundrum in the after-party hangover of successive US consumer booms. 2010 was the rebound and 2011 will be a consolidation, with oil price levels dictating whether growth is flat or as high as a few percent. Longer term, the challenge remains for container growth to find a new growth level such as 7%, down from 10% averages of yesteryear – but there is a twist. And this could be the success of growth in new production regions such as inland China, which could direct growth into a new direction.

Wal Mart’s share price, somewhat ironically, has been in a funk since its peak levels in 1999. In a sense the stock took off when investors got the memo on cheap China goods – a bit late in 1997 when they could have gotten it in 1993-94 as China’s manufacturing production really geared up following Deng Xiaoping’s famous dictum “it does not matter what color the cat is…” in the Spring of 1992 – and his tour of South China (where the breadbasket of cheap China goods production originated). Two med-term risks: 1) war, with risks rising and 2) significant increases in domestic US and developed country local goods production (cheaper domestic production).

By 2003, WMT’s share price started to underperform the market overall, and did so until the onset of the financial crisis in 2007. Since then it has traded places back and forth. What is interesting to us is how this company reflected in the biggest way the margin gains that could come from passing on lower prices to US consumers on the back of cheap China goods while earning a spread on high volumes. The volume growth story, from the chart, is best seen from 1996 through to 2005-06, when the boom in furniture for US cheaply financed homes peaked, and when the concept that China goods prices would not fall forever caught on and the US consumer started getting buying fatigue.

Our long-term thesis is that “global capitalism” could receive an injection of new life in a few years from now – after some consolidation shorter term – as new cheap production bases come on line to assist western governments and supply chain margins in their strange targeted mix of goods deflation and assets reflation. The topic is obviously complex. We discuss the supply chain perspective here in looking at containers and container shipping – and the potential for a return to goods deflation.

Wal Mart and Container Trade Volumes from Asia to US – A structural challenge anticipated by the stock substantially in advance?

Source: Transport Trackers

Question: 200m new workers needed in China?

It is easy to churn out general reports summarizing the broad movements and shifts of container box and ship fleets, and to prognosticate on long term container growth and shorter term variances – especially when one takes the recent year to repeat the current trend for the forecast, … which we have often seen done. And we don’t claim to be able to do much better in using crystal balls.

To do much more than look six months forward is highly interpretive and subject to rapid changes in forecasts. Typically we find there are 1) differing stages in a long term cycle where calling a bottom after a sell-off and a correction after a run-up are a little easier to catch; and 2) annual seasonal patterns when it is easier to call the forward few months in the middle of the year than the next year right before the Christmas season. We are currently about two years out of the bottom if we can call spring 2009 the bottom of the 2008 financial crisis. This crisis, having been broader, led to more 1:1 correlations on both corrections and rebounds. In addition, this 1:1 for correlation 2008-10 saw the China ports pattern as much more similar to global trade patterns.

Key Directional Trends 2011(Container risks 2011 already stated. This is a re-statement)

From Henry Boyd, we have gained insights into the consolidation process in container boxes. Henry has taken his analysis further than what we have seen Drewry or CI (Containerization International) do. But Henry, as for all others, still relies on some CI data, especially for long term series. We at Transport Trackers had relied on the CI data for over a decade, supplemented by Drewry, and now also Henry. The series at times do show variances – but the patterns are essentially the same.

*****

Container Box Dynamics

In 2010, approximately 2.75 million TEU were produced. With adjustments for retirements and containers built for non-commercial maritime use, the world container fleet stood at roughly 24.5 million TEU (about 27m using un-adjusted Drewry series). With a net increase of the number of vessel slot TEU to 14. 2 - 14.3 m TEU, the box/slot ratio dropped to 1.8:1.0 on Henry Boyd’s count. Alphaliner, which picked up our theme this week as well is working off of a 1.99:1.00 box to slot ratio for 2011. Our relatively less adjusted count for Transport Trackers (which looks closer to some presentations such as those of Alphaliner) showed the generic box/slot ratio stood at 2.1x and about flat on 2009, after coming off from 2.3x in 2008 – with the 2011 ratio at about 2.1x as well. The decade average is about 2.4 -2.5x.

Container TEU Production and Production Utilization, 1995- 2011 (2011 = estimated minimum need)

Source: CI; Drewry; Transport Trackers

Container $/TEU Prices and Daily Long Term Lease Rates… a 20+ year decline reversed in ’09…and a big spike it was

Sources: CI; industry reports; Transport Trackers

The baseline 20’ container price started 2010 at USD $2,000 (few delivered at this price), peaked at $2,820 for September deliveries and settled back to close the year at $ 2,700.00. The dramatic swing in pricing was caused solely by demand for scarce production as both corten steel and plywood flooring prices stayed stable throughout the year. These two items alone account for 60% of the 20’ price. Additionally because refrigerated container production continued through 2009 without interruption, pricing remained stable at the 2009 level through 2010.

The container manufacturing industry started 2010 with an almost non-existent production workforce having furloughed most of its employee base during the 13-14 months the factories were closed from late 2008 through the end of 2009. This required the manufacturers to recruit and train complete workforces. Their efforts were further hampered by difficulties in retaining workers who prefer assembling consumer products to working on a heavy industrial shop floor. As a result, 2010’s production was almost completely based on single shift production.

Once the manufacturing industry’s workforce is re-built to support a two shift environment a full order book annual production capacity should be in the 5.0 to 6.0 million TEU range a substantial increase from where things stood at the end of 2008, a result of production line improvements and expansion during the 2009 hiatus.

The implication of strong pricing and full order book suggest that while 2010 might not go down in the record books as the year with greatest production, it may definitely be the most profitable for the manufacturers (or at least in 1H11 based on momentum). This has given rise to a number of comments from the purchasing community that the shortage of suitable workers may not be as acute as portrayed by the manufacturers.

Going forward in 2011 the container order book looks strong buoyed by the new vessels that have, and will, enter service.

There have been claims that 2011 will be a record year for box production, suggesting the manufacturers will be able to fully implement two shift work schedules and get to 4m TEU production levels (2007: approx 4.1m TEU produced).

We are skeptical this will happen in 2011 for a number of reasons:

1) From an engineering perspective, we believe the container manufacturing workforce is too inexperienced. Multi shift production requires a strong cadre of experienced floor supervisors. Line workers can be easily, and relatively quickly, trained. Line foremen need work experience. With the bulk of the production workforce having less than a year of experience, the pool for supervisory staff looks thin;

2) More importantly the manufacturers seem to have learned the lesson of supply and demand, with demand being preferable to oversupply;

3) Capital raising constraints may still limit smaller players from raising all the money they need, though the big players have had a field day squeezing out the little guys.

Representing a turnaround from recent years, container leasing players moved to dominate purchases and acquired 60% of 2010’s production. Leasing companies made a wise tactical move in 2010 and purchased production space early in to lock out competitors and customers alike. With production under contract, the leasing industry was able to successfully pass along not only increases in lease rate attributable to container price changes, but also increase their profit margin. This is evidenced by the growth in the ICIR (Initial Cash Investment Return - per diem x 365 / asset cost) metric from 12.5% in 1Q10 to 14.3% at year’s end on dry freight equipment for five year operating leases.

Reefer lease rates also remained stable at the 2009 levels in line with unit pricing.

All of the leasing companies were reporting utilization levels in excess of 97% by year’s end. In a global equipment rental business this means that everything that can possibly work, is working. While good news for the lessors, this also has an impact on the value of used containers. Leasing companies are the market leaders in the sale of used equipment, choosing to dispose of equipment before its useful life is over to maximize gain on sale profit and to keep the age of their fleets low. However, when lease utilizations go up, the available pool of saleable containers goes down and prices go up.

2009 and 2010 suggest to us a number of things. Firstly, the era of cheap containers is over for now (our TT view is the market comes off from high base during 2011, while the perception of tightness from 2010 lingers...Longer term we expect box demand to increase relative to ship slots again given a low box to slot ranging from 1.8x to 2.1x).

Our thought is that containers have come full circle and are for now at least being built and marketed as transportation equipment, and not as a mechanism to freely export steel and gain hard currency. With this change in point of view, and clear evidence that the manufacturers finally “get” supply and demand, the days of below cost containers to keep factories running will become a memory for awhile longer (and set us up for a new cycle – a look at long term IRR and lease rate charts from the 1980s must be seen to fully appreciate what hit container yields in the last 20 years!).

While the order book demand will be strong, we find it hard to believe the manufacturers will either be able, or willing, to increase 2011’s production level much beyond 20-25% of the 2010 level, orto 3.3 - 3.5 million TEU (and not 4.0+ m TEU as some have called for). But 2012 delivery levels can be debated more. We also believe the leasing industry will be on the forefront of purchases again in 2011 as it still positions to get back some of the lost market share from past years. Again, they will be using their purchase orders as a competitive advantage to block out liner company purchases. We also see lease utilizations staying high through 2011 and in turn propping up used equipment values. High oil prices and consumer demand levels and potential high oil price impact on consumption should be a major point of debate on demand impact for 2H11 into 2012.

Not Surprising Similar $ Cost Shifts, 1980 – 2012E (TT View: price rebound highs in 2010…but where settle is key)

Source: CI; Clarksons; Drewry; Transport Trackers

Final Thoughts on Boxes

There are many who for 18 months have said that container box shortages would only last a short while, and we sided with this view initially in its strict form (ie, boxes are a commodity that are relatively quickly brought back to equilibrium), by mid-10 we had a more modified view which was that the perception of scarcity would create the same effect as a shortage.

We have believed since mid-10 that this shortage mentality would last through much of 2011 – driven by some of the smaller container line players we spoke to. However the issue now to watch is how it lasts as we go in to the peak season, and if it fades faster than expected.

High oil price and lower demand growth in long haul with slightly lower vessel utilizations could take the pressure off box needs short term.

Longer term there is another effect that could come into play, which is a lengthening of the supply chain as more boxes go inland into China. But this will be something to watch further down the road. We still have the aftershocks of 2007-09 to understand shorter term.

In closing the discussion we note a few write ups talking up the shortage of boxes again in the last two weeks – this is strategic mumbo jumbo positioning by the lines first, and a continuing or an attempt at continuation of the recent trend on tight boxes second. Yes – there is still some tightness. But 1) we are farther along in terms of this effect and it is not as severe as in 2010 and 2) we have yet to fully digest higher oil prices due to the current N Africa/Arabia crisis.

Ships and Boxes Looked at Together

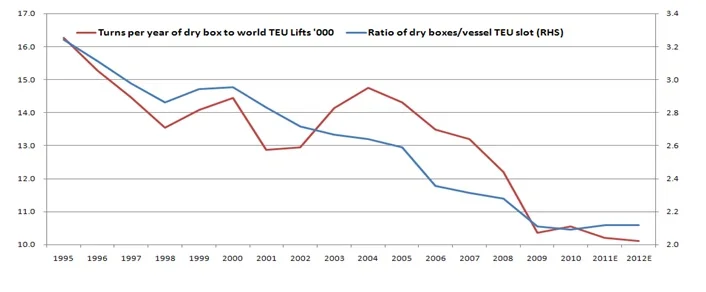

BOX TURNS: Partly Logical Given Trade Pattern Shifts … but also Partly Puzzling (the divergence in 2002-05…)

(Initially greater box efficiencies, higher trans-shipment/more double counting…Less boxes inland US….Slow Steaming…But later more boxes inland China?)

Source: CI; Clarksons; Drewry; Transport Trackers

The curve separation between box turns (box trade over standing vessel TEU) and the ratio of standing box fleet to standing vessel TEU during 2002-09 can be partly explained by what happened during this 2004+ period was a tendency for box turns to decline partly due to greater growth on the longer Asia-Europe trade as well as the earlier deceleration in the shorter Transpacific trade. The peak of growth in the Transpacific Eastbound was about +17% in 2004. Asia-Europe peaked in 2006 at about 22% (subject to variances on exact % growth). The trend may also be attributable tolarge volumes of inventory containers that were ‘exported’ as empties in excess of import levels from N. Americaand Europe in this time period.

What gets interesting is when we look at relationships few have looked at before – like the ratio of capex for ships to that of boxes. The alternate ship capex to box capex (dark red line below) and the trendline show the privileging of capex deployment for ships over boxes, which goes hand in hand with less boxes available per vessel TEU slot.

Vessel Capex Got Out of Hand Relative to Boxes for Little While (LT trend also a little out of whack)

Source: CI; Clarksons; Drewry; Transport Trackers

Getting Back to Container Shipping

When we get back to looking at container shipping, using our long term graphs, which admittedly always have to rely on paucity of data in earlier years, we establish a few clear trends:

1) The increased volatility of capacity, demand and rates in recent years (last seen in 80s), and,

2) A general long term trend toward rates to react to excess capacity increases and decreases

What we find to be generally the case is we don’t even need to adjust and make assumptions which require constant fine tuning for all the explanations, theories and pattern shifts thrown out there, including most notably the famous case a few year ago of needing to adjust down effective slots more on bigger ships, increased trans-shipment long term, shifts in growth and deceleration in longer haul trades, and most recently slow steaming. Slow steaming, we think, has had the greatest effect in terms of absorbing excess capacity. Yet even with this, the relationships between “excess slots” (capacity growing in excess of demand growth) and $/TEU rates for container lines is still noticeable.

WARNING: Rates do Respond to Visible Excess Capacity (black arrows point to capacity surges; purple arrows to drops)

Source: Transport Trackers

Note: of course the whipsaw action set up 2008+ given greater volatility… (again we would like to thank Mr Greenspan….)

Long Term TEU Liftings Demand and Vessel TEU Supply, 1981 -2013E

Source: Transport Trackers

MAD Shipping V1.2 and the Long Term Implications of the Maersk Move….”Please ante up”

These are macro driven pivotal moments we live for. The implications of these forthcoming changes cannot be over-emphasized and will possibly be useful for building and adjusting investment strategies for several years. We have mentioned that ports tend to benefit more from this development, all things equal, as well of course being more defensive historically. But certain equipment makers from yards to crane makers will receive a share of benefits. (When we mention ports we are not supporting one type of port per se, and certainly not S China ports relative to others, for instance. Re the Hutch Ports story, for instance, this case will have its own set of parameters to consider.)

The oil trade: These vessel size and capex developments will be separate from another trend we have seen come back which is the container shipping trading pattern with oil trade, which could show more similarity with airline share fluctuations around oil price moves. The "oil related trade" will have its own life, although the topic is connected at a deeper level in terms of operating costs analysis of course. Higher oil impacts operation costs – and older vessels will face higher costs if oil stays at a higher level.

***

1. Reiterating our more recent 2011 bearish comments on containers, and

2. Based on discussions which brought it all together for us…,

3. But cognizant that some players in addition to or in spite of Maersk could benefit

4. Underscoring that a next wave of mergers or closer alliance could come out of this as well…

It is our hope that many investors and shipping lines will conduct further investigations into the risks of a vessel arms race at this juncture. On the one hand it is compelling to go for the latest toy and reduce unit costs. On the other hand it could lead to a shorter useful life for many vessel types resulting in more wasted capex to throw under the rug of balance sheets.

Bottom line: Maersk with their new 18,000TEU ship (which was flagged as early as Nov 10) have raised the stakes and raised the bar to stay the leader in the game, using a) their economies of scale and b) profits from other divisions as buffers, and indicated their willingness to continue facing huge swings in EBITDA and EBIT from continued turbocharging of the cyclical nature of shipping and container shipping to attempt yet again to squeeze out key competitors. A tough challenge to be sure.

Relative Stay in Game players: The Asian carriers, mainly HK, Taiwan and Chinese will have to follow and will have the benefit of access to cheap capital to chase Maersk with their own capex strategies. ... The Europeans and related will not be so lucky, but will have to chase as much as they can. No surprises here.

Ship owner vs ship operator: Shipowners who put too many eggs in the 2006-08 part of the capex cycle will face obsolence issues on assets they overpaid and which will exhibit higher operating costs if oil remains high. Shipowners with earlier purchased vessels, depending on acquisition price, will also be impacted. Take a 2005 ship that was valued initially partly with a 7-year or more charter. When the ship comes off charter it will be returning to a different world, one which no longer pays it the same charter rate level.

Ship operators will be affected too – in a similar way that bond holders can be affected by a change in the structure of interest rates between long and short maturities.... or by changes in debt credit ratings. Issues of fleet profile must be considered carefully -- THE QUESTION: How is the current vessel portfolio between owned and long term charters affected in terms of the ongoing run rate of committed capital and operating costs?

The relative winners: key Korean yards on a relative basis and a couple of Chinese yards who can benefit at the margin. Equipment makers and dredging and engineering companies.

Retooling likely vessel deployments: 10,000 TEU ships could become the choice vessel to US West Coast and the 8,500TEU (2014 Panama Canal) to East Coast for premium services (Virginia the only post panamax ready port currently… and funding issues for others to consider). 14,000TEU and 18,000 TEU ships will be the cost winners for Asia Europe. Cascading, the act of shifting a once large ship from long haul into short haul, will be accelerated. But this will face its own issues and problems. The issues will percent of fleets that can shift over what time frame. Some argue that all obsolete ships will be automatically scrapped. Would it be so easy. Unfortunately this will not happen overnight and will be a drag on vessel utilizations and returns before the scrapping decision gets made.

The irony: After over-spending on capex in 2006-08 the liners are faced with the prospect of doing it all over again or face competitive obsolescence. The traditional scavenger strategy will be tried by MSC and others who may seek to emulate this strategy – which could be to make up for not having the lower operating costs by getting cheapships AFTER the loss of value of the newly obsolete models. Who knows, it could be that some of the top 10 lines could be further pushed to merge together. Some of the obvious combinations could come back out of necessity.

Historically we have seen certain favorite shiptypes shift. For instance the early 5000-5500 TEU ships will become more obsolete. The relatively new 6000-6500 TEU ships will face the risk of becoming part of a sandwich class. Ships that cannot be properly cascaded will be the ones facing the bigger discounts – which will then become either scrap or scavenger targets.

The face of Intra-Asia trade will shift yet again. Bigger ships. New needs for smaller ports. Shifting feeder relationships.

The irony here is also that all these operators and the industry in general have all moved from 18-20 year type depreciation schedules toward 25 year type depreciation policies in the last decade or so – and yet here we will be with ships built in 2004 which are or were perfectly good ships which will effectively be deserving of an economic impairment charge …. Which of course will be resisted or denied by auditors, banks, owners, and operators.

Plus ca change… There are still a few rough edges as we work on further updates on long term implications.

The Plan to Bankrupt the Competition and Create a New Vessel Arms Race … MAD Shipping for Short

A new version of “we must remain #1” updated for new technology and new economies of scale was born in late 2010, as we initially followed early reports DSME was readying a new vessel design for Maersk to start delivering in 2013. The new 18,000TEU vessel design was too big to contain and came clean a few weeks ago. The only trade for the vessels was always going to be the Asia-Europe trade, of course. The Transpacific will have to content itself with 8,500TEU and 10,000TEU in the near future. The perversity and beauty of the game is that large liner companies will be forced to match the economies of scale in key East-West trade lanes or not be able to match prices which come from lower slot, fuel and operating costs per TEU slot.

Triple E 400 meters $190m 18,000TEU (a few meters longer and wider, but with square bottom and 23 across the ship carries lot more than 15,000TEU Emma Maersk)

Source: Maersk Please visithttp://www.maerskline.com/triple-e and http://www.youtube.com/watch?v=fxFs5LpDsQU

Total World Domination…the Winners and Losers

Source: James Bond, Never Say Never Again

The Triple-E in its push to innovate will feature:

- 20 % less CO2 per container moved than Emma Mærsk, believed to be the most efficient container vessel in operation today and 50 % less CO2 per container moved than the industry average on the Asia–Europe trade lane;

- 35 % less fuel consumed per container than the 13,100 TEU vessels being delivered to other container shipping lines in the next few years;

- Ultra long stroke engine waste heat recovery system captures and reuses energy from the engines’ exhaust gas for extra propulsion with less fuel consumption. Power to engine will be increased 9% (some debate, but some complaints…);

- Hull and propulsion systems are designed to profit from slow steaming, rendering fuel consumption benefits of 20 % at 22.5 knots, 37 % at 20 knots and 50 % at 17.5 knots;

- E class vessels will be documented and mapped in the vessel’s ‘cradle-to-cradle passport’. When the vessel is retired from service, this document will ensure that all materials can be reused, recycled or disposed of;

- $190m vessel implies $10,555/TEU capacity slot cost (and it would be cheaper with less innovation)

The Slot cost comparisons are pretty clear from a capital deployment per unit of TEU slot capacity. There was spike up in costs/TEU a few years ago. Now there is a double shift down again: The first shift down is lower cost per ship and per TEU slot due to the after effects of the financial crisis and the second shift is from the renewed upsizing bias.

TEU Slot Costs by Vessel Size, 1980 – 2013E ….The difference is about 30%....but that is only half the story

Sources: Clarksons; Market reports; Transport Trackers

What Comes after Maersk's Triple-E Containerships?

If the Maersk “Triple-E” containership order makes a large slice of the world’s fleet uncompetitive, what will the future threat to the Maersk triple E look like? We can assume very different configuration for containerships in the not very far distant future?

According to recent work by the Norwegian classification society DNV; “the low energy ships of the future will be larger, be made of lighter materials, carry little or no ballast water and be equipped with a host of different measures attempting to minimize fuel consumption and greenhouse gas emissions.”

Their description also includes:

- drag reduction technologies

- hybrid lightweight materials

- multi-propulsor configurations

- and hull design features such as “trapezoidal” hulls

Technologies that were considered too expensive just a few years ago are now becoming cost efficient.

Whilst DNV and other support the LNG option for propulsion, they also promote the concept of the electric ship that they expect will boast this set of ten technologies:

- Parallel hybrid power generation (where the electric motor acts on the drive shaft in parallel with the engine)

- Super-capacitors for higher energy density

- Large lithium batteries

- Fuel cells

- Solar panels

- Flywheels that provide rotational energy

- Retractable wind turbines

- Wave energy collectors

- Cold ironing in port

- Superconducting generators and motors

The electric ship suggestion is in contrast to the claim by classification societies are saying that LNG fuel engines are virtually way that the next wave of low sulphur rules can be met.

By 2015, Sulphur Emission Control Areas (SECAs), which are established in environmentally sensitive areas in Europe and North America, will set the maximum SOx levels at 0.01% versus the current level of 0.1% LNG would eliminate all SOx and particulate matter, cut NOx by 90% and CO2 by 20%.

To date, the experience of using LNG in ships is limited to ferries and offshore support vessels, but the propulsion system will be extended to coastal and short sea ships, of which a half dozen are now on order. Of note a first small 2,000 dwt capacity vessel with LNG fuel was ordered by an owner who was chasing the potential savings, rather than environmental concerns. The Norwegian NOx fund will provide NOK18m of the additional NOK28m. Built in a Turkish shipyard, once delivered in 2012, the vessel will be supplied weekly by a local LNG bunker station.

There is European money for the gas solution. One Danish owner, Fjordline , has secured EUR9m ($12.4m) in European Union funding to install liquefied natural gas tanks and dual fuel engines on two ferries being built in Poland. The funds, yet to be received, come from the Marco Polo scheme, which falls under Brussels’ Motorways of the Sea program. The Finnish government backed LNG fuel capabilities on a new Viking Line ferry to be built at STX Finland this year. The only other sizeable vessels to be ordered with LNG as a fuel are two ro-ros from Norway’s SeaCargo. Again, the additional building expense has been supported by the Norwegian NOx fund.

There has, as yet, been no commercial order for a gas-powered vessel in northern Europe in which the owner has not tapped into some form of financial aid to build the vessel.

There was some speculation that Maersk’s Triple E ships would be LNG fuelled but the containership segment is far away from the day of an LNGbecause the industry is stuck in a chicken and egg situation. The fuel suppliers won’t provide the ready supply of fuel until the fleet is there to buy the fuel and the owners won’t buy LNG fuelled vessels until the fuel supply is there.

The solution from DNV is that container ships should be built today with the capacity to retrofit with LNG storage tanks so that when the world has an LNG bunker network, then the ships can be refitted quickly.

DNV has also unveiled “a new crude oil tanker concept that is fuelled by liquefied natural gas, has a hull shape that removes the need for ballast water and will almost eliminate local air pollution.” There are some parties holding out hope for scrubbers to solve the sulphur problem.

Wärtsilä, one of the marine industry’s leading ship power solutions providers, has signed a turnkey contract with Containerships Ltd Oy to retrofit a Wärtsilä fresh water scrubber onto a small containership. This is Wärtsilä’s first commercial marine scrubber project for a main engine. The scrubber will be delivered to the customer in August 2011. The conversion will enable the vessel to meet future sulphur oxides (SOx) emission requirements in Sulphur Emission Control Areas.

In addition to LNG, there is a serious consideration for LPG because it does not require the low-temperature storage technology, thereby doing away with some of the problems peculiar to LNG engines.

The low sulphur rules will create new challenges for shipping, not to mention the burden that shipping will have to bear from the surge in oil prices. We are also aware that shipping is squarely in the cross hairs as a politically easy target due to its green house gas (GHG) footprint.

Appendix – China Ports Snapshots

China Vs World ‘000 TEU and Greater China as % of World, 1993 - 2010

Source: Transport Trackers

Where’s the Growth? 1997 – 2010 Indexed Container Moves at China Ports 1997 = 100

Source: Transport Trackers

Authors: Charles de Trenck/Matthew Flynn/Henry Boyd / Publisher: SCMO