Reproduced from a 2008 article published in the <em>Far Eastern Economic Review</em> <em>(now deceased</em>) — Reproduced by courtesy of <em>Charles De Trenck</em> — At the time, Mr. De Trenck was head of Asia transport research at Citigroup and had been following shipping since the mid-1990s.

A piece I wrote for the <em>Far Eastern Economic Review</em> last year (“Shattering Shipping Myths,” June 2007) might have seemed overly pessimistic at the time. I sketched out a scenario where demand for manufactured goods from Asia and China fell off steeply as a result of a property bust in the United States, as food andenergy costs rose further. Events have unfolded faster than I expected, largely because shipping demand in Europe slowed quickly and there was a sharp decline in U.S. inbound volume. The one bright spot has been a healthy rebound in U.S. exports.

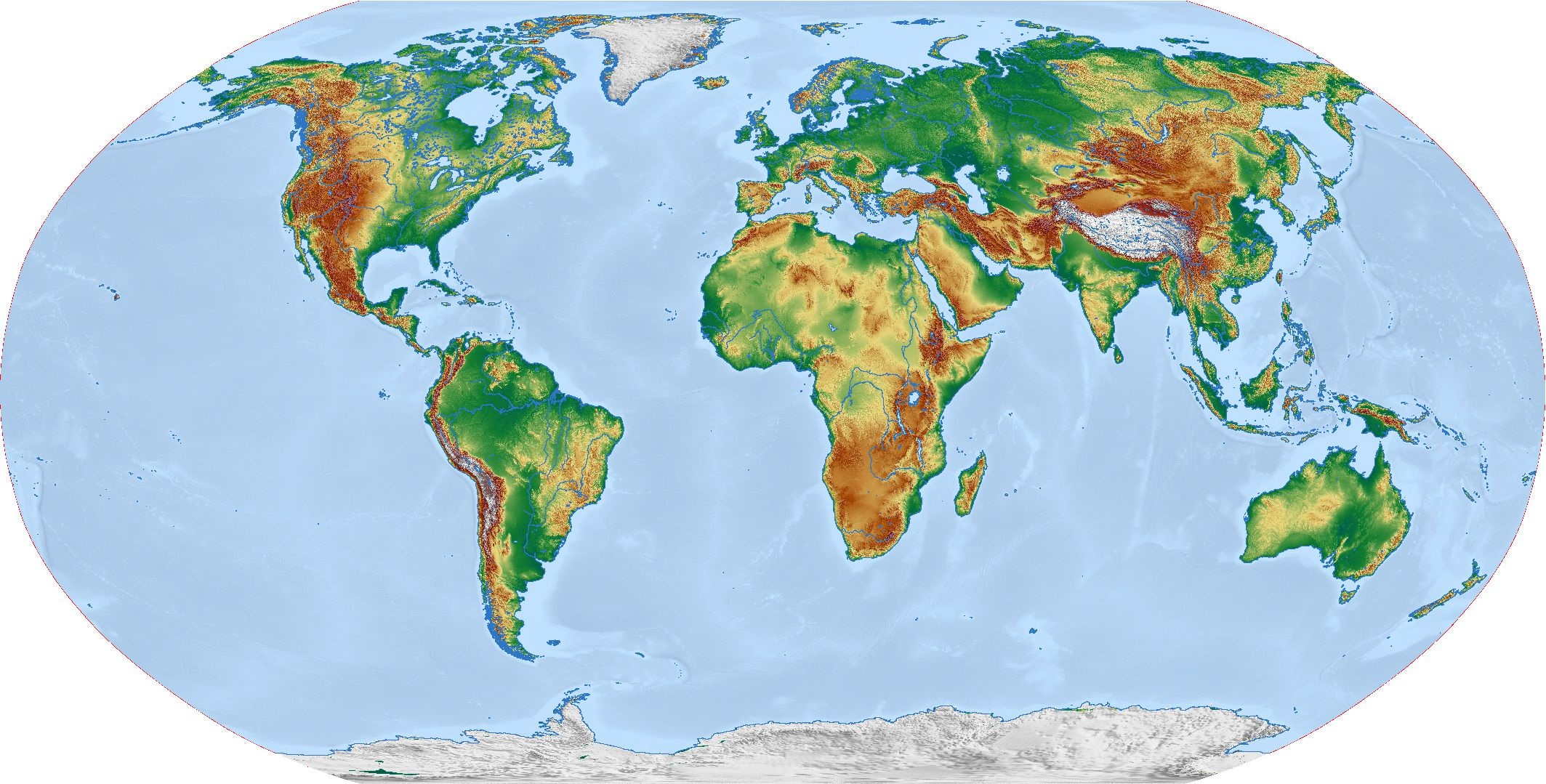

Shipping, as ever, is a window into global trade and the global economy. Looking deeper into the global container industry can today elicit a better understanding of shifting trade patterns, rising production costs and declining consumer demand. And in comprehending the current slowdown in Asian exports and in global trade in general, we should now be looking at the slackening pace of economic activity and its impact in terms of how far along we are on the downward slope, and more importantly, how might growth trajectories shift us further down or back up.

Right now, we should be close — a matter of months perhaps — to a bottom in terms of export deceleration from Asia to the U.S. As for the European side of the equation, we are perhaps another six to 12 months away from a bottoming of export growth rates. Yet there are likely to be some notable differences from previous downturns. In?ation — coming after a long period of low interest rates — combined with China and commodity booms and a shifting role for the dollarare all part of this potent cocktail.

Using the economic slowdowns of the 1970s and 1980s for comparison is not straightforward given that global supply chains for manufactured goods were still relatively embryonic back then. Even so there is much to learn from what happened to bulk and tankers after the 1970s boom. What we should try to track is the difference between trade growth by volume and value, focusing on the ?ows of manufactured goods. Today, containerized trade transports far higher amounts of high-tech goods, as well as steel parts and agricultural commodities than was the case 20 years ago. With container trade tracking, we can look at both container port performances and vessel transport growth in order to better triangulate patterns.

China’s container port volume growth is slowing more than nominal trade statistics indicate. Total port volumes grew 17% in May and 15% in April, this level representing a signi?cant slowdown from the 23% levels one year ago. Shanghai, Shenzhen, Hong Kong and Qingdao have all seen overall volumes signi?cantlybelow the current average. Trade export values in dollars grew 28% in May and 22% in April (versus averages of around 28% one year ago). The difference represents a decline of about four percentage points.

China container ports have seen volume growth rates shift down from percentages in the mid-20s range to percentages in the mid to high-teens (when we exclude Hong Kong), representing a decline of about seven percentage points. The change in differential is at least a few percent, with the issue of the yuan only indirectly related. When we adjust to include Hong Kong in the calculation, which we must do at some stage given that Hong Kong still handles substantial chunks of China trade, up to 10 percentage points of growth are lost in the differential between value and volume.

Since 2007, trade volumes on container ships out of Asia have slowed to low single digit growth, but the value of trade relative to the volume of trade — the rise of prices in the system — has shifted up. The Asia export value data taken against container export volume growth, shows a distinct pattern: The value of goods’ exports is increasing faster than the volume of goods. The China export data, which of course represents the single largest component of Asia exports, shows the trend even more clearly.

The China trade and Asia container data for May give a clear warning that the value-volume differential is growing rapidly in 2008. This is starting to look a little like inflation with Chinese characteristics — which takes us back to the potent in?ation cocktail of low real rates and high commodities prices brewing in recent years.

That China volume growth would slow down somewhat was expected. And yet everyone has continued to think of China as the world’s workshop for cheap goods without realizing that volumes can lose out to higher prices. China’s input costs have shot up as have transport costs, of which one-third are fuel costs, while developed country demandin volume terms is shifting down more rapidly than can be seen using conventional terms such as store sales. Could it be that in?ation as glossed over with cpi-adjusted statistics is the wrong measure to use? Our tracking of the value-to-volume gap tells us instinctively this has been one of the built-in problems in tracking trade for years. It did not matter when volumes and values were similar. But it matters now.

The markets recently learned the U.S. consumer has shifted down demand, especially in volume terms. No doubt the U.S. consumer will stage rebounds in demand, especially if oil prices come back below some magic number such as $100. But what if the American consumer is forced to dispense with his or her disposable consumer society behavior for a couple more years because the pocketbook has shrunk and goods are structurally higher in price?

Inflation that has progressed from commodities to ?nished goods — higher steel prices to higher ship prices, to higher prices of Chinese goods — should work in reverse once demand slows. But not before bringing down average volume demand growth rates further. Until 2007, long-term growth of volumes from Asia to the U.S. was about 10%, with 2007 itself already coming at zero. The current run rate for 2008 is looking to be minus 2% if we stop decelerating in the ?rst half of 2008. To put that in perspective, long-term global containerized trade has runningaround 9% to 10% , with the U.S. driving the largest portion of that growth until 2006 and 2007, and Europe taking over in 2007.

Now the picture we are getting in 2008 is worse than expected in volume terms. Into the U.S., growth not only has slowed into ?at or negative year-on-year growth for a few months, but we are now down for the last 12 months on average. We have to go back to 1995 and 1996 to ?nd the same kind of volume slowdown. And Europe inbound container volume, which has seen long-term growth closer to 15% and about 19% in 2007, has also decelerated rapidly and is now running at the 10% level in 2008, and even that level is thanks to some continued pocketsof strength in the newer markets of Eastern Europe. The areas of weakness encompass most of old Europe.

To make matters worse, new ships are increasing the supply of shipping capacity. Demand in volume terms has decelerated about 10 percentage points on the key Asia-export trade lanes, while the more expensive recently ordered ships (regardless of operation speeds) will only be coming on line faster in the coming two to three years.

In?ation is still on the rise. Input, production and transport costs have all gone up. The question is when and how prices might fall as excess capacity forces shippers to compete for scarce customers. For the moment, we can’t assume cost pressures will ease soon. Thus we can’t assume demand volumes are finished declining — though we can speculate as to a potential deceleration in declines. As demand declines, there will be great opportunities to lower transport costs, and also to identify investment opportunities once lower growth gets priced in. But Asia needs to face the fact the run rate of demand is shifting down and that we don’t know just yet how this story will end.

Author: Charles De Trenck / Publisher: SCMO