At some point in the next 200 million years, according to Yale University scientists, the North American and Eurasian tectonic plates will collide at the North Pole. When they are eventually joined by Africa, the singular super-continent will re-emerge, reminiscent of the Pangea that existed hundreds of millions of years ago.

Until that time, however, the vast oceans that separate North America from the western and eastern halves of Eurasia will continue to have a major impact on the evolution of geopolitics. The pace of globalization has altered our perceptions of space and time:

Communications technology inspires many to proclaim the “death of distance.” Yet a contrary narrative is also emerging, one in which America’s distance from Eurasia places it on the wrong side of the world from the “cockpit of history,” a rapidly integrating Eurasian super-continent that is shaping its own future independently of the Western Hemisphere and the U.S. And the technology that is driving this epochal transformation is one of the most traditional: railways.

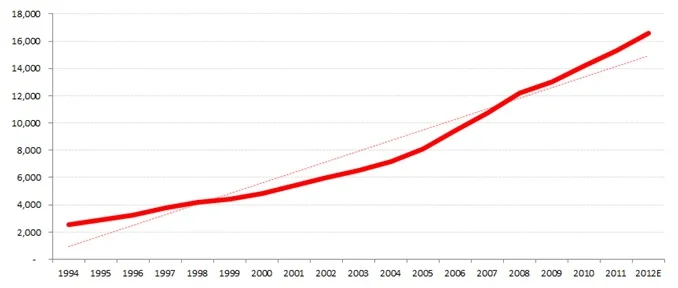

Earlier this month, China announced plans to invest an additional $140 billion into 25 new rail projects across the country as part of its massive stimulus campaign aimed at creating jobs and modernizing national infrastructure. China lays more than 5,000 miles of new railway track each year domestically (and by 2020 should have more high-speed rail than the rest of the world combined), and is sponsoring the modernization or deployment of new rail lines across Eurasia towards Europe as well, which has long led the world in mass transit with 24 of 27 countries featuring high-speed rail already. By comparison, the U.S. has failed to muster even the modest $50 billion proposed by President Barack Obama for rail projects. The resulting portrait is appears bleak: while America licks its wounds at home, Chinese blood is pumping through Eurasian veins as the more populous and important hemisphere unites into an organic whole.

Compressing geography

“There lies within the breast of every Englishman an inborn love of railways,” wrote Christopher Portway in Corner Seat, one of several chronicles of his intrepid but cursed Cold War period rail adventures across the clash, and the romance, of civilizations that is the world’s largest landmass. For many, rail travel is still stuck in Portway’s era of the Orient Express. Cultural foibles at customs and border clearing frustrations often plague trips south or east of Poland. Portway constantly haggled for transit visas at checkpoints of countries that spontaneously took on anti-Western moods like Syria and Albania. He made colorful use of the Cold War labels of “pink” for Yugoslavia and “red” for Bulgaria to capture their degrees of unfriendliness.

British adventurism and ambition have clearly suffered since the collapse of the Empire. Whereas railways helped the British Empire

penetrate into the heart of Africa and Asia, by the 1990s London newspapers were waging a fierce debate as to whether Britain or France would benefit more from the Eurostar train linking the two former global powers.

Today, rather than Britain steaming out into the world as it did when it led the Industrial Revolution, China is now steaming its way to Britain more quickly than anyone seems to realize. This westward movement is the unfinished business of the Industrial Revolution—and the reversal of its outcome. History can be turned on its head so quickly. Or corrected, depending on your perspective.

Rail is indeed the 19th century’s preferred mode of transport, but is getting major technology upgrades that give it renewed significance in the 21st. First, the export of Europe and Japan’s high-speed rail systems to China is eventually making cross-Eurasian rail travel more than the romantic overland equivalent of a transatlantic cruise. With state-subsidized rail industries and plenty of short-haul business travelers, Europe and China combined have invested more than $200 billion in high-speed rail in 2009 alone; in Italy, even a private conglomerate, NTV, is running high-speed rail traversing the country.

The oil-rich Gulf Cooperation Council (GCC) monarchies are planning a high-speed rail along the Persian Gulf. Worldwide, private rail expenditure is expected to reach $500 billion by 2020. China has only 413 airports to America’s 5,200, but has more than 8,000 kms of high-speed rail, and laying thousands more kilometers of track every year. Under the radar, private American rail operators have spent $23 billion on rail upgrades—but all for freight rather than passenger transit.

Second, Eurasian rail is finally entering the Information Age, getting its equivalent of the IATA or AMADEUS systems which allow for seamless booking across airlines. Silver Rail Technologies, a transatlantic startup, is harmonizing rail carriers and their ticketing networks beyond the Franco-British Euro-star and Benalux Thalys trains to reach eastward to Russia and beyond. Today, boarding the Eurostar train at St. Pancras station in London is very much like boarding a plane:check-in, passport control, security X-rays, customs, and “landing cards”—except you never leave the ground, and in fact go under it, crossing one of the narrowest and most strategically contested waterways in European history, the Straits of Dover. The “Chunnel” opening between the U.K. and France was thus as important a symbol of European unity post-World War II as the euro currency (which the U.K. cleverly did not join).

Traveling from Scotland to Singapore (or reverse) by train seems like a gap-year backpacker’s itinerary, or just another endless carefree rite of passage for any Australian. It is undoubtedly the Holy Grail of rail travel: a seamless connection across the furthest distance that could conceivably be traveled on a single rail track.

But it also marks the ultimate compression of geography, smoothly traversing the world’s largest, most diverse and turbulent landmass. The distance from London to Shanghai is the same as London to San Francisco, and Eurasia boasts most of world’s population. It has always been—and will always be—the going concern of geopolitics. Today Eurasia is being densely knit together through an infrastructural exoskeleton of railways and pipelines: Iron Silk Roads.

Today’s Eurasian railways are connecting East and West at unprecedented speeds. The Harmony Express, currently the world’s fastest train, connects Wuhan and Guangzhou at speeds of 250 mph, so could cover the distance from London to Edinburgh and back in just three hours (today, that journey takes 12 hours). Imagine when China completes negotiations with the 17 countries between itself and Great Britain for a high-speed rail to be completed by 2020. The railway would connect Beijing Central to London St. Pancras in just two to three days. That’s more than twice the distance as from New York to San Francisco in the same amount of time—and likely far greater comfort—than Amtrak.

Over the past decade I’ve made several Eurasian voyages, lengthy journeys that attest to Eurasia’s moniker as the indomitable “world-island.” These include driving across Europe, the Balkans, Turkey and the Caucasus to the Caspian Sea in a beat-up 1990 Volkswagen, in busses across the post-Soviet Turkic Central Asian republics, in a Land Cruiser across all of mountainous (and largely road-less) Tibet and Xinjiang in western China, and driving a hulking, three-ton British Army surplus Land Rover ambulance 11,000 kilometers from London to Mongolia (with the steering wheel on the wrong side). Bumping my head countless times against the roofs of these vehicles, I’ve often thought about how much easier it would be for masses of people to travel by rail than on roads that take much longer to pave and rarely withstand the elements.

And the masses are ready. For 60,000 years, migration has been the face the globalization, facilitated by ever faster transportation and communications technologies. Today, 200 million people are considered expatriates, formally living outside their home countries. Colonialism was a key driver of migrating labor across the British Commonwealth, for example, while voluntary migration brought most of America’s original population across the Atlantic. Recent years have witnessed a further surge of economic migrants not seen since the post-War era. Chinese are wandering inland to new frontier cities for work, Mexicans bypassing America for Canada and even Europe where the currencies are stronger, South Asians to build the new Middle Eastern metropolises of Dubai and Doha—and since the financial crisis, Americans sending their c.v.’s to Shanghai and Singapore hoping for a break (or salvation) in the emerging markets.

As we enter the age of mass commercial rail travel, the movement of people will yet again tip the balance between economic dynamism and depopulated malaise, but also create dislocation in labor markets, social tension, and even political upheaval.

Hail to the rail

China borders more countries than any other nation in the world. Since the Soviet collapse two decades ago, it has diligently sought to settle borders with almost all of its neighbors (except India). In doing so, it has paved the way to literally pave over those borders with roads, railways and pipelines. The long-term consequences amount to nothing less than re-writing international relations for Asia, away from the rigid Western Westphalian system of national sovereignty towards the more traditional pattern of Chinese core-periphery relations that has dominated Asian history since ancient times. The kingdom of Tibet and Uighur Turkic province of Xinjiang (China’s largest state) have already been fully incorporated into the Chinese state. Now the logic applies even to Western allies such as South Korea, and newer partners like Vietnam. Because China doesn’t want war with either Vietnam over the South China Sea or South Korea in the event of a messy North Korean collapse, it is likely to shift course away from the current experimentally aggressive posture back towards the commercial and cultural “smile diplomacy” of the 1990s.

It is ironic that in this age of space-based weapons and cyber-war, rail may still be the most influential tool of geopolitics, as it was

during European empire-building in the 19th century. Indeed, it is rail infrastructure that is the most visible manifestation of China’s western expansion, a five-finger strategy of railways, roads, pipelines, and other supply chains traversing Russia to Europe, Kazakhstan to the Caspian Sea, Kyrgyzstan and Uzbekistan to Turkmenistan, across Afghanistan to Iran, and traversing Pakistan to the port of Gwadar on the Arabian Sea. Here’s our map of this trend (or try this at home: place your right hand in front of you, palm facing forward and thumb down with fingers stretched widely: the back of your hand is China, your pinkie Russia, and your thumb Pakistan.) When Chinese goods flood the streets of Berlin and Paris, and Middle Eastern oil arrives overland to China instead of through the Straits of Malacca, it will be by such traditional geo-strategic design.

The extensiveness and density of these corridors, the harmonization of rail gauges and accelerating speed of trains, the cooperation of customs officials to diminish visa requirements, and the rising demand for Asian goods across fast-growing frontier markets all add up to a sea change in how we think about Eurasia’s various zones and segmentations. China clearly looks at Eurasia holistically—and opportunistically. In the post-modern Chinese world-view: Mongolia is not land of Genghis Khan but “Mine-Golia;” Turkmenistan not an ancient caravan civilization but a gas station. Along the way, giant and non-descript shopping malls like Dubai’s “Dragon Mart” will be the no-frills industrial caravanserai of the 21stcentury, pulling in goods from across Eurasia and selling them wholesale to cost-conscious travelers in both directions.

In the coming decade, each time a Eurasian regime falls or thaws—and they all will, from Moldova and Belarus to Syria and Iran to Uzbekistan and Myanmar—their societies become under-served markets to be flooded with goods, and their geography a strategic passageway for East-West railways. Many places vie for the moniker “where west meets east”: the Ural Mountains, Istanbul, and Dubai, among others. But the compression of Eurasia through infrastructure makes the East-West dynamic less a tangible place than a transition zone.

This process of compression has the power to marginalize current debates about the identity of today’s struggling post-Soviet nations. Today, Ukraine and Belarus appear caught between European and Russian gravities; tomorrow both will be conduits of thriving East-West commerce. Even Russia, still the world’s largest country on the map, will demographically shrink to the size of Turkey with almost its entire population lying west of the Urals. The Cold War joke seems eerily prescient: “There are no disturbances today on the Sino-Finnish border.”

The geographic compression of Eurasia is occurring faster than political institutions can cope. No multilateral organization such as the European Union (EU) or Shanghai Cooperation Organization (SCO) regulates the new Eurasian land bridge whose map of nodes looks more like a subway map in a rendering created by Chor Pharn Lee, a futurist in the office of Singapore’s prime minister.

Within China, a circular network connects Beijing to major city-clusters such as Shanghai/Nanjing in the east, Pearl River Delta in the south, and interior hubs such as Chongqing. Outside China, westward corridors stretch towards Europe, and undersea links connect to Korea’s southern commercial hub of Busan and Japan’s revitalized port of Fukuoka. To the south, Kuala Lumpur would be the penultimate station, just an hour on high-speed rail from the terminus at Singapore, making the island city-state ever more both a land and sea hub.

Market control

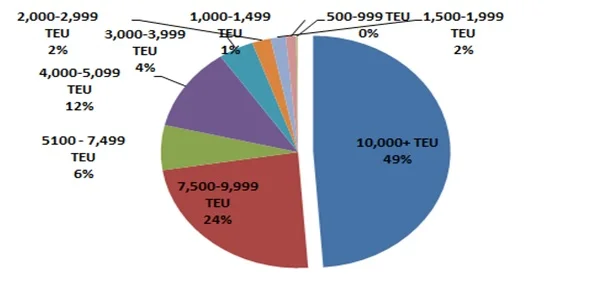

One major reason high-speed rail will spread across Eurasia is that China now builds it. Having previously scrapped its “China Star”

venture, China’s Locomotive & Rolling Stock Industry Corporation (LORIC) now competes internationally for high-speed rail contracts and has signed agreements with Turkey while bidding across Russia. Most of the world’s rail equipment is still manufactured by Western heavyweights Bombardier, Siemens, Alstom, and GE. But like other sectors in which intellectual property has been transferred (or stolen), China has hijacked the intellectual property around high-speed rail as well.

Global power, at least from the Asian perspective, is still very much about population size, natural resource endowments and access, and territorial control. But the mechanisms of control have evolved. As the UCLA geopolitical scholar John Agnew explains, power increasingly derives not from fixed or static control over natural resources within bounded territories, but rather through regimes of “market access” that maximize control over the flows of goods, capital and innovations; market-building rather than empire-building. With railways, oil pipelines, underground fiber-optic cables and other technologies moving resources and capital faster than ever, China does not need to conquer colonies the way the Europeans did; it can simply buy them.

China is building new geopolitical “facts on the ground” all over Asia, from deep-water ports in Sri Lanka to signals intelligence stations in Myanmar to coastal special economic zones in North Korea. Wang Menshu of the Chinese Academy of Engineering has drafted the plans for multiple high-speed rail routes emanating from China. A southern route through Indo-China is already under construction by way of refurbishing the rail systems of smaller and poorer states like Cambodia. High-speed and freight rail plans are already in development to link China to Thailand via Vietnam and Laos. Southern Chinese provincial cities like Kunming then become regional hubs for entire sub-regions of Eurasia. As Myanmar thaws, it could become the strategic arbiter of a significant corridor of Sino-Indian trade as the Asian giants vie to maximize gas exports in either direction. Thailand is planning a wide highway to Katanchanaburi on the Myanmar border from which it will connect to a new port called Dawei. The route roughly follows the old River Kwai death railroad. China wants Dawei to connect the short distance overland to Thailand’s big deep water port of Laem Chabang so it can complete avoid importing oil and other goods via the narrow Straits of Malacca. Geography is no barrier for China, only an obstacle to be surmounted with sturdy infrastructure. Even as suspicion of Chinese motivations and tactics is rising from Myanmar to North Korea, no other investor is willing to undertake such massive projects and absorb such huge risk.

In the 20th century, the world looked to America to provide the “public good” of security; protecting freedom of the seas and the flow of oil. In the 21st century it is infrastructure that is the necessary public good, and it is being largely financed by China. Under the umbrella of the Shanghai Cooperation Organization (SCO), China has pledged tens of billions of dollars in infrastructure modernization funds to its poor, post-Soviet neighbors. As we know from Africa, there is no price too high for China to pay, or infrastructure project it will not subsidize, in exchange for access to oil and minerals.

But while the political friction along what could be a kaleidoscopic Orient Express today remains far too intense even for China, hyper-modernizing Russia’s creaking rail system is the easiest, flattest route for China to pursue in compressing its westward march. Mr. Wang refers to Russia simply as the “Northern Route.” From London to Beijing is just over 5,000 miles; London to Singapore about 6,800.

Before Britain ruled its empire on which the sun never set, Russia had become the largest contiguous territorial power since the Mongols, stretching from Eastern Europe to North America (Alaska) by 1866. Railway expansion enabled Tsar Alexander II to invade outer Manchuria in 1868, and leverage Central Asia and Siberia for supplying Russia’s World War I efforts.

A century and a half later, even as Russia’s vascular system of oil and gas arteries and veins is pumping overtime, its skeletal structure is cracking. Gazprom, which by some estimates provides close to half of the federal tax revenue, takes care to keep up what it needs to keep energy flowing, while Moscow neglects the rest in favor of military modernization for a degenerating army. Russia is far too big for itself. Its population is dwindling to that of Turkey’s (but hardly as young or robust) while consolidating in its European sector west of the Urals, while its GDP is scarcely larger than Holland’s. Its status on a map and its dismal reality are the ultimate geopolitical imbalance, one that is being gradually corrected by the combination of a Chinese influx northward across the Amur River, the thawing of Siberia’s permafrost due to climate change which is making the region a major breadbasket, and the wholesale liquidation (pardon the pun) of Russia’s oil, gas—and increasingly water—through multi-billion dollar agreements with China. Russia exists to fuel China and Europe – and increasingly to connect them as China modernizes Russian rail.

On CNN International today, you’ll frequently see a commercial for Russian Railways showing a stylized map with a zigzagging rail route linking Western Europe to eastern Russia. The impression given is of a Russian seamlessly traversed for Eurasian business. And it will be – but thanks to China. China’s “Northern Route” is nothing less than an overhaul of the Trans-Siberian railway, whose lore now far surpasses its reality. Portway once wrote, “I was happy to wax eloquent on the subject of the Trans-Siberian Railway, but can find little to praise in the cities it serves.” China’s influx of passengers and consumers will re-invent the hulking over-wraught frontier outputs such as Novosibirsk, while its tourists will surely over-run attractions like Lake Baikal. China wants to resurrect and extend the Baikal-Amur branch of the Trans-Siberian, which borders the 100 million strong Heilongjiang province, to smooth the import of all the aluminum and other metals it is investing in with Russian oligarchs.

As with the modern project of the European Union itself, infrastructure across civilizational boundaries is about boosting trade, creating energy corridors, promoting cultural exchange, and reshaping politics all at the same time. Consider how it used to take six weeks to deliver freight on trucks from Slovenia’s port of Koper to Istanbul due to Balkan checkpoints. Now as each former Yugoslavian republic has Stabilization and Association Agreements (SAA) with the EU, they have been forced to play nice to receive substantial grants for infrastructural renewal from Brussels. Now customs procedures don’t hold up cargo as it covers the distance in less than two days. Another strategic waterway is also about to be tunneled by rail: the Bosporus Straits that divides Istanbul – and with it separate Asia from Europe – will also have an underground rail connection called “Marmaray” (uniting the Turkish words for Marmara Sea and “rail”). Set to begin operations in 2014, it is projected to increase rail traffic in congested Istanbul from 3.6% to over 27%.

Further eastward into the Caucasus, the Baku-Tblisi-Ceyhan pipeline already provides a growing share of Europe’s oil imports from the Caspian Sea to Turkey, and a major EU-funded road and rail project (called “Traceca”) has boosted cooperation among traditional rivals like Georgia and Azerbaijan. This Southern Silk Road, then, is simultaneously an economic development program, political stabilization tool, and vehicle for expanding the EU all at once.

Where pipelines speed the flow of oil and gas, railways often follow. By 2018, the Nabucco pipeline may also be completed, carrying Kurdish, Azeri, and even potentially Iranian gas all the way to Europe. In the other direction, the Iran-Pakistan-India (IPI) and Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipelines will further reduce the isolation of landlocked Central Asia and bring Caspian resources outward to world markets. The crucial state in these schemes – Iran – is one of the world’s top oil and gas suppliers and cannot be isolated forever. Already a freight rail corridor links Istanbul to Islamabad via Iran, carrying $15 billion in goods annually. Eventually, through war or diplomacy, Iran’s resource and demographic energy will be unlocked as well.

America’s isolation

America’s much-touted “pivot” to Asia is not without justification, but it might be without foundation. In other words, America cannot properly engage Asia only across the Pacific; it needs to look across the Atlantic as well. A decade ago, Henry Kissinger warned that, “The U.S., separated from Europe, is geopolitically an island off the shores of Eurasia like nineteenth-century Britain.” As China steams westward across Eurasia, the U.S. needs a unified and expanding European Union to serve as a continental counterweight. Indeed, unless we re-conceive the entire notion of the “West” as a three-pillared zone of Europe, North America, and even South America, the clichés about the indomitable East dominating the Earth will become certain prophecies. Much as a half-century ago when NATO and the EU served as the strategic and political bulwarks against the westward expansion of communism. That task may still be necessary, even though China is communist only in name.

Kissinger’s book was titled Does America Need a Foreign Policy? It does, of course, but that does not mean it has one. Understanding the fundamental importance of global strategy for America is as basic as looking at a globe. America is actually in the wrong time zone. It is the last major power to complete the day, perpetually chasing the rest of the world in time. The late Citibank executive Walter Wriston famously prophesized that, “Time zones are more important than borders.” He meant it as a statement about the power of global markets. But it also says a lot of America’s future position in a world where more people may be traveling across Eurasia by rail than flying across the Atlantic to America.

American scholars use terms like “global disorder” to characterize the post-Cold War, post-9/11 world simply because they refuse to appreciate the order that is in fact emerging before our eyes and being built every day. The more Eurasia organically knits itself together, the more America appears an insular island on the other side of the world from this epochal new order.

So this is what the most important landmass on Earth will look like in a post-American world.

In theory, America’s weakening leverage over Eurasia should mean that rivalries should explode between China, Japan, Korea, Russia, and India. But Asia need not become a chaotic vortex in need of American intervention—which in any case has a recent track record of producing chaotic vortexes. Instead, Asia’s future could be much like its past: the bumpy re-emergence of centuries old Silk Roads. The smoothest paths will be Asian financed railways efficiently ferrying the world’s largest populations of the East across and towards the depopulating zones of the West. In Portway’s day, the trains seemed to run on time everywhere, except in Britain. Under Chinese control, the trains will surely run on time everywhere.

As all of this transpires, America will be fine. Its navy will still be parked off the Pacific Rim, able to bail-out and back-up some allies who get into confrontations with China, while taking a beating in the process. Back home, shale gas will bring down prices at the pump, and if the government can redistribute rents towards infrastructure renewal, the economy will rebound more equitably than either the dot-com or finance booms. And the Western Hemisphere may also unite, a dream as old as that to control the Eurasian heartland. Until the tectonic plates collide again.

Author: Parag Khanna / Publisher: SCMO