Article published on December 2014 in Legal Eye and reproduced by courtesy of Stephenson Harwood

The International Air Transport Association (IATA) released its first ever 20 year global passenger growth forecast in October 2014, which predicts annual passenger numbers will grow from 3.3 billion this year to 7.3 billion in 2034.

The Global Passenger Forecast Report, put together by the new IATA Passenger Forecasting Service, working in association with Tourism Economics, analyses airline passenger flows across 4,000 country pairs for the next 20 years, using three key demand drivers: living standards, projected population and demographics, and price and availability.

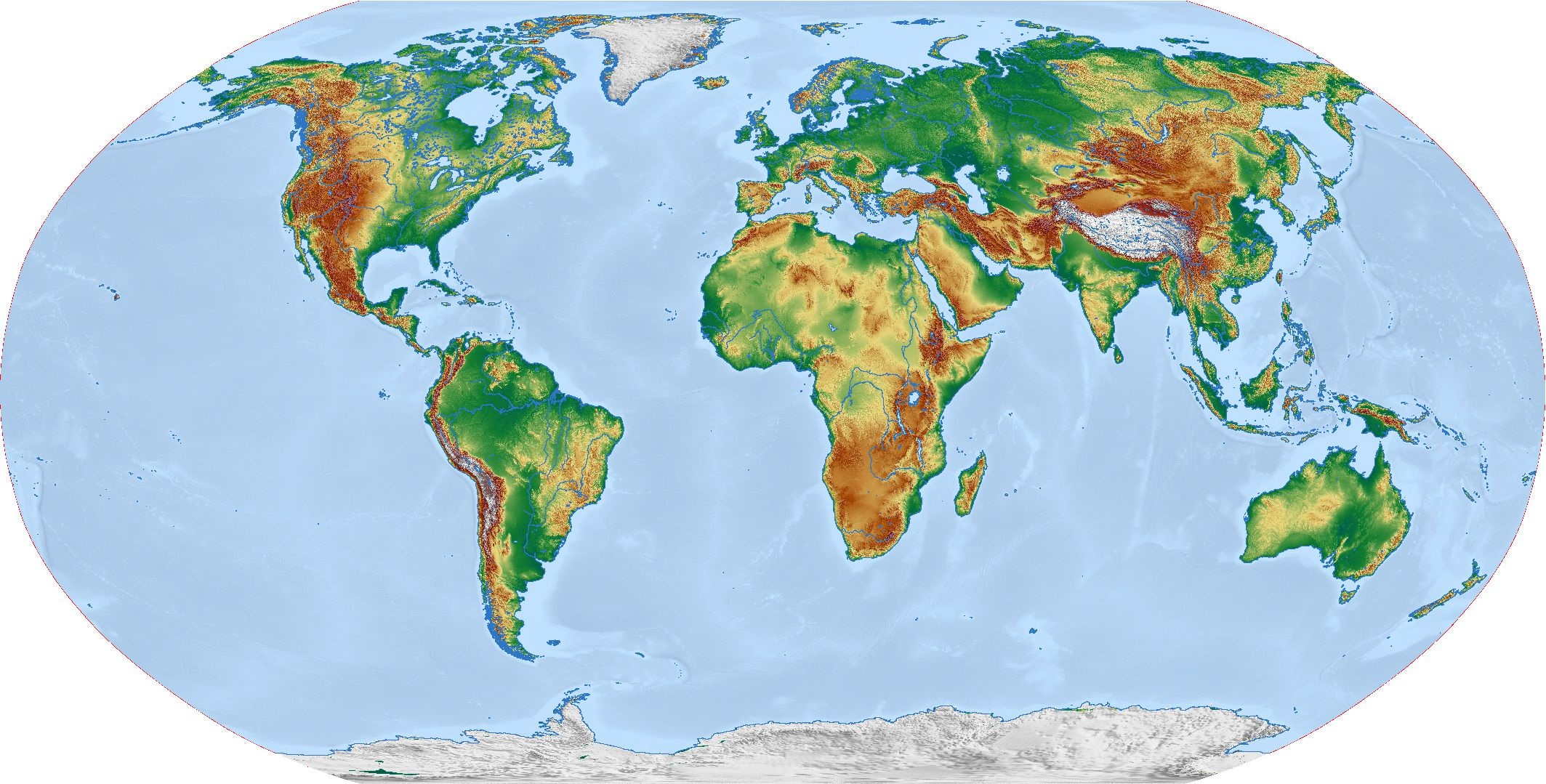

The Report forecasts that China will overtake the US as the world’s largest air passenger market by 2030, and that by 2034, the five fastest increasing markets, in terms of additional passengers per year, will be China, the US, India, Indonesia and Brazil. Eight of the ten fastest growing markets in percentage terms will be in Africa, and the highest growth in terms of country pairs is predicted to be in Asia and South America, reflecting economic and demographic growth in those markets.

The Report highlights the fact that meeting the forecast growth in global air passenger numbers, which represents a 4.1% average annual rate of growth, will require government policies that support the economic benefits that such increased levels of air connectivity will make possible.

Tony Tyler, IATA’s Director General and CEO, said the following:

“Airlines can only fly where there is infrastructure to accommodate them. People can only fly as long as ticket taxes don’t price them out of their seats. And air connectivity can only thrive when nations open their skies and their markets. It’s a virtuous circle. Growing connectivity stimulates economies, and healthy economies demand connectivity.”

Tyler points out that at present, aviation helps sustain 58 million jobs and US$2.4 trillion in economic activity, and that in 20 years time, IATA has projected that aviation will support over 105 million jobs and US$6 trillion in GDP.

IATA’s forecasts for the 10 largest air passenger markets (defined by traffic to from and within) for the next 20 years:

- The US will remain the largest air passenger market until around 2030, when it will drop to number 2 behind China;

- India will grow from being the 9th largest market to the 3rd, overtaking the UK around 2031, which will fall to 4th place;

- Japan will decline from the 4th largest market to the 6th largest by 2033, reflecting a declining and ageing population;

- Germany and Spain will decline from 5th and 6th positions to be the 8th and 7th largest markets, France will fall from 7th to 10th position and Italy will fall out of the top ten largest markets completely in or around 2019;

- Brazil will rise from the 10th largest market in 2014 to the 5th largest by 2034; and

- Indonesia will enter the top ten around 2020 and will attain 6th place by 2029.

The Report recognises that air travel has an environmental impact, and states that in 2009 the industry agreed three targets so as to ensure that aviation plays its part in ensuring a sustainable future:

- 1.5% annual fuel efficiency improvement by 2020;

- Capping net emissions through carbon-neutral growth from 2020;

- A 50% cut in net emissions by 2050, compared to 2005.

In the same week that the Global Forecast Report was published, IATA released the results of its quarterly Business Confidence Survey of CFOs and heads of cargo, which forecasts growth across the airline industry over the next year. Management of airlines are predicting largely positive profit expectations for 2015, notwithstanding some downside risks associated with the weaknesses in the Eurozone economic recovery, the Russia-Ukraine crisis, and some knock on effects from the Ebola crisis.

“Eight of the ten fastest growing markets in percentage terms will be in Africa”

Author: Paul Phillips (Partner, Head of aviation litigation and regulation with Stephenson Harwood) / Publisher: SCMO